per capita tax meaning

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. What is Per Capita Income PCI.

How Is Tax Liability Calculated Common Tax Questions Answered

It can apply to the average per-person income for a city region or country and is.

. I did not receive my per capita tax bill. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Consider talking to a financial advisor.

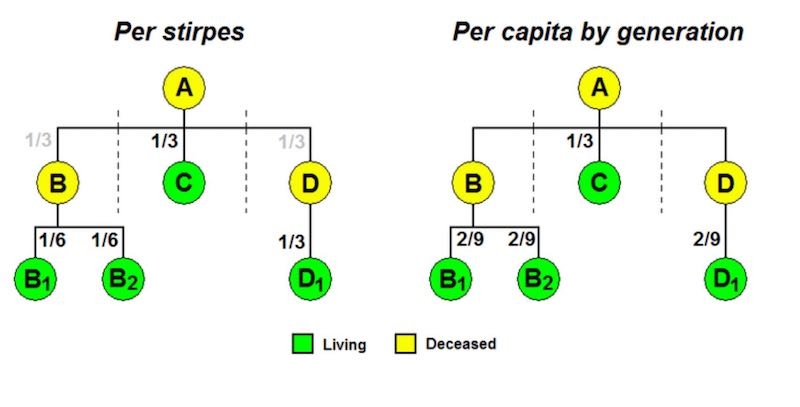

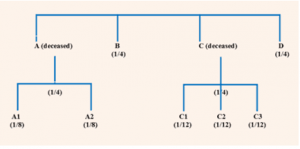

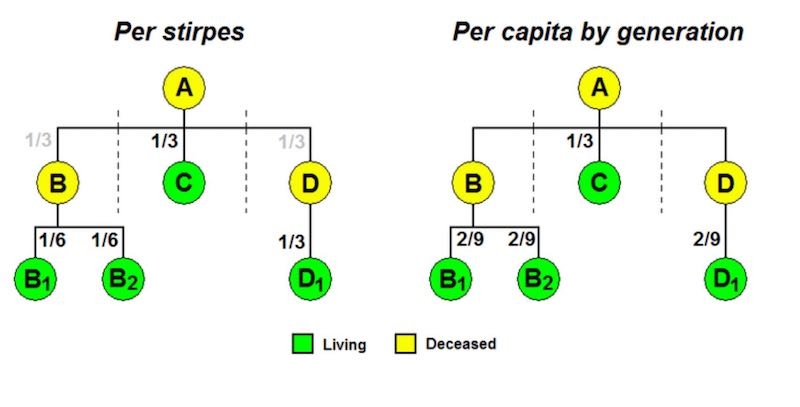

Per Stirpes Distributions. It means to share and share alike according to the. Should a beneficiary die these remain in effect.

Latin By the heads or polls. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing.

It is calculated by dividing the areas. How to use per capita in a sentence. For most areas adult is defined as 18 years of age or older.

The definition of income per capita is simply the average amount of money earned by people living in a specific area. Per capita distributions could trigger generation-skipping tax for grandchildren or other descendants who inherit part of your estate. The meaning of PER CAPITA is per unit of population.

Per capita is a Latin phrase meaning by head Its used to determine the average per person in a given measurement. The per capita income of a geographical location say a country state city or others measures the amount of money earned by every person in that. A term used in the Descent and Distribution of the estate of one who dies without a will.

This tax is due yearly. Usually per capita calculations are done for cities states or. Become null and void should the beneficiary die.

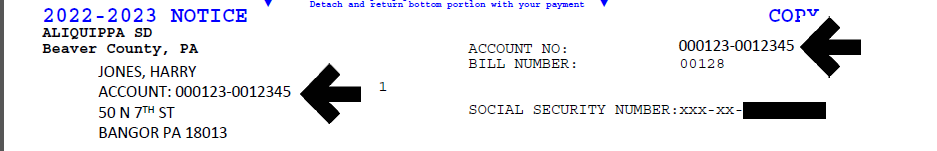

For most areas adult is defined as 18 years. What is a Per Capita Income PCI. Can you provide me with my invoice number so that I can make a payment online.

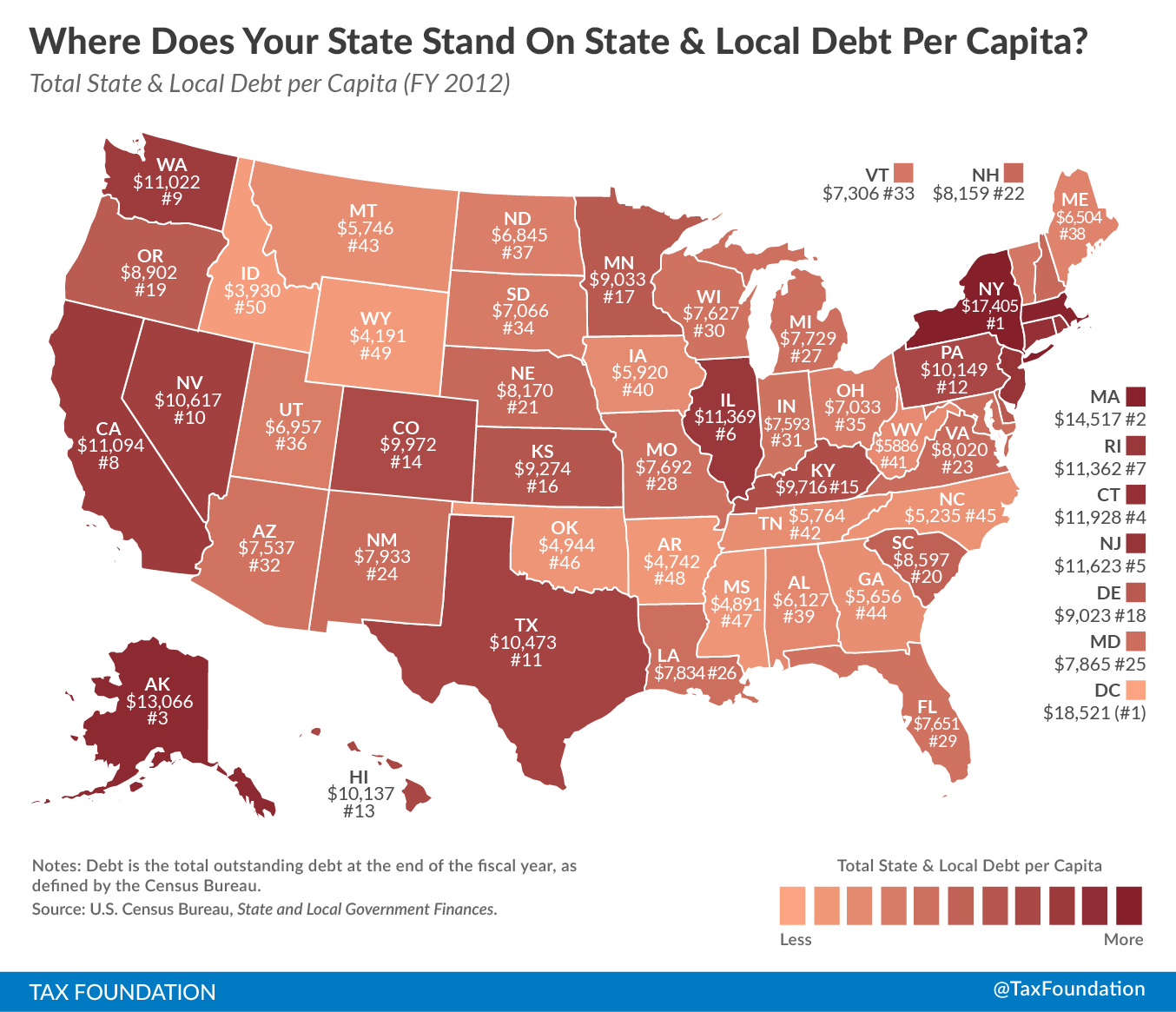

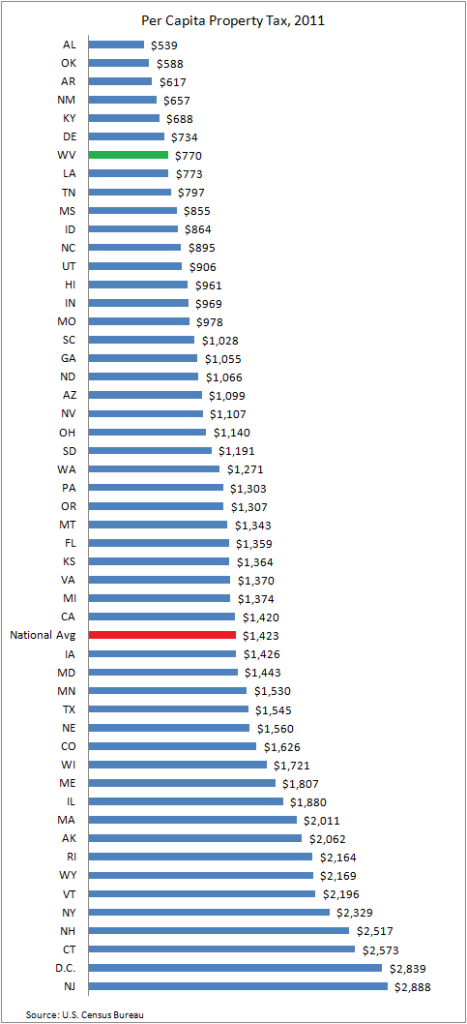

Property taxes are an important source of revenue for local and state governments. I lost my bill. Per stirpes per capita and similar designations typically apply to retirement accounts and not taxable accounts because those fall under your trust or will.

What is the Per Capita tax. By or for each person. Can I confirm the balance due for my tax bill.

Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a. In fiscal year FY 2016 the most recent year of data available property taxes. For example a common way in which per capita is used is.

Income per capita is a measure of the amount of money earned per person in a certain area.

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Per Stirpes Vs Per Capita Death Benefit Policygenius

Understanding California S Sales Tax

Per Stirpes By Representation Per Capita What Do They Mean Russo Law Group

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Argentina Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

State Local Property Tax Collections Per Capita Tax Foundation

U S Per Capita Consumption Of Soft Drinks 2018 Statista

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Information About Per Capita Taxes York Adams Tax Bureau

Property Tax Definition Property Taxes Explained Taxedu

How Is Tax Liability Calculated Common Tax Questions Answered

The Difference Between Per Stirpes Per Capita And By Representation

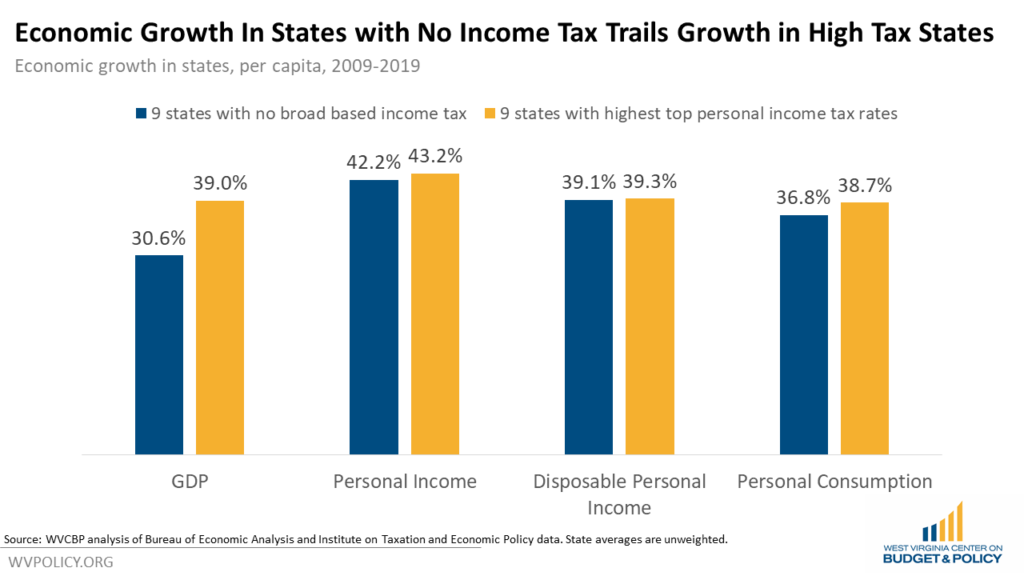

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)